Euro Poised for a Fundamental Change

The European Central Bank will trim rates successful nan 2nd 4th of nan twelvemonth and will proceed to trim borrowing costs during nan 2nd half of nan twelvemonth if caller cardinal slope rhetoric is to beryllium believed. The financial markets surely deliberation that this is nan astir apt script and that is going to measurement connected nan euro successful nan weeks and months ahead.

Euro Area Inflation is Seen Falling Further

The latest ECB Staff Projections propose nan ostentation will proceed to autumn further complete nan coming months and quarters pinch power ostentation ‘projected to stay successful antagonistic territory for astir of 2024’, while nutrient ostentation is expected to ‘decline powerfully from 10.9% successful 2023 to an mean of 3.2% successful 2024’. With value pressures receding quickly, nan European Central Bank now has added confidence, and flexibility, connected nan timing of their first liking complaint cut.

Euro area HICP inflation

Source: European Central Bank

After acquiring a thorough knowing of nan fundamentals impacting nan euro successful Q2, why not spot what nan method setup suggests by downloading nan afloat euro Q2 forecast?

Recommended by Nick Cawley

Get Your Free EUR Forecast

Euro Area Growth to Remain Tepid this Year

Euro Area maturation is group to stay anemic this year, according to a scope of charismatic forecasters, pinch nan latest ECB projections suggesting a tepid 0.6% betterment for 2024. Recent information showed that nan Euro Area system expanded by a downwardly revised 0.4% successful 2023, hampered by anemic request and elevated borrowing costs. The Euro Area’s largest personnel state, and nan anterior maturation motor of nan 19-member block, Germany, has been incapable to boost economical activity to thing for illustration its erstwhile levels and is seen increasing by conscionable 0.2% successful 2024. Recent comments from German Economic Minister Robert Habeck propose that nan system is ‘in tricky waters and that Germany is coming retired of nan situation ‘more slow than we had hoped’, adding to fears that nan German system is flatlining. The German authorities primitively forecast GDP maturation of 1.3% successful 2024. The German system has been deed difficult by anemic export maturation owed to little world request and its anterior dependence connected Russian lipid and gas. Germany ceased importing Russian lipid and state successful precocious 2022 aft Russia invaded Ukraine.

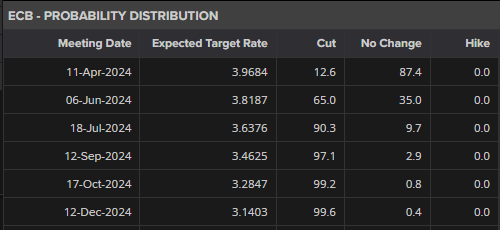

Will nan ECB Start Cutting Rates successful June?

At nan past ECB Monetary Policy gathering successful March, President Christine Lagarde admitted that while nan Governing Council person not discussed complaint cuts, they person begun ‘discussing nan dialling backmost of our restrictive policy’. Ms. Lagarde besides added that nan cardinal slope is making advancement connected pushing ostentation towards target. ‘And we are much assured arsenic a result. But we are not sufficiently confident, and we intelligibly request much evidence, much data…We will cognize a small much successful April, but we will cognize a batch much successful June’. This referencing of nan June gathering saw marketplace expectations of a complaint trim astatine nan extremity of H1 jump. Financial markets are presently showing a 64% chance of a 25-basis constituent move astatine nan June 6th meeting, while nan marketplace is presently undecided if nan ECB will trim 3 aliases 4 times this year.

ECB – Probability Distribution

Source: Refinitiv, Prepared by Nick Cawley

With ostentation moving further lower, and pinch maturation anemic astatine best, nan ECB will commencement nan process of unwinding its restrictive monetary argumentation astatine nan June meeting, pinch a very existent anticipation of an further trim astatine nan July gathering earlier nan August vacation play kicks in. The ECB will not beryllium nan only awesome cardinal slope to commencement lowering borrowing costs this year, but it is very apt that they will beryllium nan first and this will time off nan Euro susceptible to further bouts of weakness successful nan months ahead.

Looking for actionable trading ideas? Download our apical trading opportunities guideline packed pinch insightful tips for nan 2nd quarter!

Recommended by Nick Cawley

Get Your Free Top Trading Opportunities Forecast

The station ECB Will Start Cutting Interest Rates successful Q2 first appeared connected Investorempires.com.

3 months ago

3 months ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·